I am sharing a thought about how to save money from salary. When I received my first salary, I thought saving money would be easy.

As soon as my salary arrived, I thought, “I’ll spend a little and save a little.” I thought the process would be simple.

But in real life, things turned out a little differently.

Every month, until the third week, I would repeatedly check my bank balance, trying to understand where my money was going. I wasn’t buying any luxury items, nor was I living a luxurious lifestyle yet my balance was rapidly depleting.

If you’re earning money but still can’t save, understand this isn’t just your problem.

Why Most Struggle to Save Money From Salary

Most people think that low income is the main cause of savings problems. The real problem lies in mindset and not following the system.

As soon as money comes into your account:

- Subscription plan payments are deducted

- Bills are automatically deducted

- Daily small expenses (coffee, snacks, etc..) are incurred.

And we plan to save at the end of the month. And by the end of the month, there’s no money left for savings.

Therefore, stress increases, guilt comes, or the same cycle repeats again next month.

Consumer Financial Protection Bureau (CFPB)

Example: How to Save on a $1,000 Monthly Salary

Let’s look at a realistic example, no motivation talk.

Monthly Income: $1,000

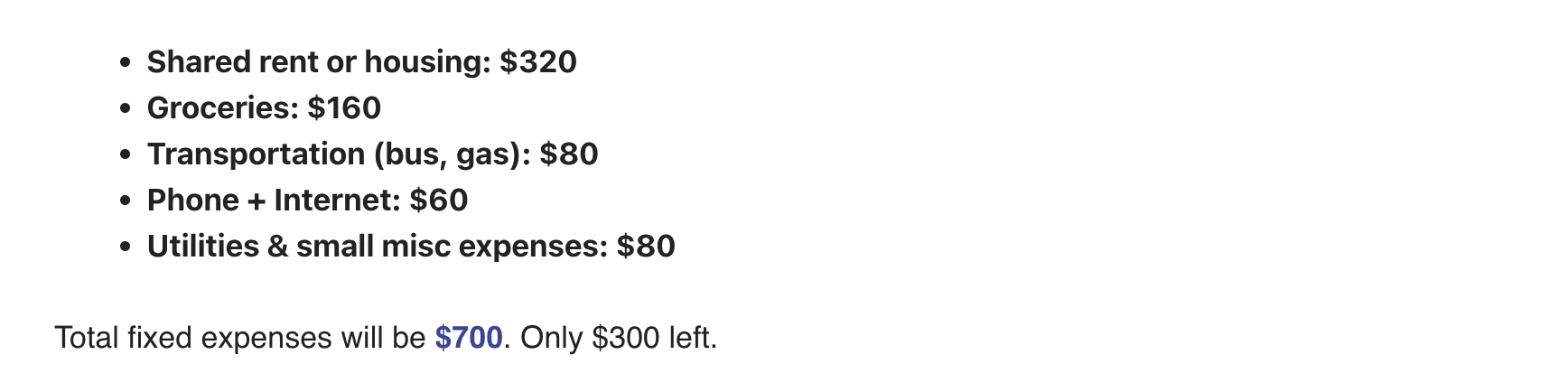

Expenses:

The problem here is that this $300 seems extra, but it’s actually the most risky amount – because it includes eating out, online shopping, and random expenses.

Why the 50-30-20 Rule Often Doesn’t Work

Internet advice says:

- 50% needs

- 30% wants

- 20% savings

But when rent alone reaches 35–40%, this rule creates pressure. And, People start to feel like failures, even though it’s not their fault.

With a low or tight income:

- Flexibility works better than rules.

- Small, realistic goals are better.

- Emotion and behavior are more important.

So, creating your own system is better than following strict rules.

Now I am going to tell you about the 5 steps that I followed, I hope this will help you a lot.

My 5-Step System to Save Money From Salary

Step 1: Save First, Even If It’s Just $20

Most people put savings last. But by the time it comes last, the money is already gone.

So as soon as you receive money or salary:

- Immediately put $20–$40 into savings.

- Even if the rest is spent.

The amount may seem small, but it builds a habit. And that habit leads to bigger savings in the future.

Step 2: One No-Spend Day Every Week

A no-spend day doesn’t mean you should go hungry. It simply means avoiding unnecessary spending.

For example:

- Skip the coffee shop

- Don’t order food delivery

- Delay online shopping

If you save even $10–$20 a day, you’ll clearly see the difference by the end of the month.

Step 3: Cash or Envelope Method for Daily Spending

It’s easy to swipe a card, so we overspend. Cash is a little uncomfortable—and that’s its power.

- Withdraw fixed cash for weekly food and transport expenses right away.

- When cash runs out, spending naturally stops.

This method brings control without much thinking.

Step 4: Emergency Fund Before Any Investment

Many people prfioritize investing over saving. But when an emergency strikes, they resort to credit cards.

So first:

- Build an emergency fund of $300–$500

- Keep it in a simple savings account

This provides peace of mind and reduces the risk of debt.

Step 5: Don’t Wait for a Higher Salary

Waiting for a salary increase is the most common trap.

As income increases:

- Better phone

- Better lifestyle

- Higher expenses

- Savings still remain zero.

If you can save $20 today, you can save $100 tomorrow.

So, Focus on habits, not salary.

Mistakes I Personally Made

I’ve made these similar mistakes:

- Treating credit cards as free money

- Ignoring $5–$10 daily expenses

- Skipping savings and investing directly

- Making a budget and then giving it up within a week

These mistakes are normal. The important thing is to learn from them.

Simple Tools That Actually Work

You don’t need any fancy finance apps.

Simple things work:

- Writing down expenses in phone notes

- Doing a 10-minute money review on Sunday

- A simple monthly goal (like saving $50)

Consistency is key here.

Can You Save Money on a Low Income?

You absolutely you can.

If you:

- Not perfect, just regular

- Are saving a small amount

And, In 6 months:

- Fear of money subsides

- Feeling in control

- Confidence naturally increases

Lastly, I want to tell you how to save money.

What you don’t need is:

- No need – High income

- No need – Complex budget

- No need – Finance degree

You need:

- Simple system

- Honest effort

- Daily consistency

Even $20 saved every month can slowly change your relationship with money.

I hope after reading this article, you will understand that saving money is not a big deal, we just have to act with consistency and keep our expenses under control. And you can easy to save money from salary. If you have any doubts then you can ask me here any questions.

FAQs

Start with what feels possible, even 5%. Increase gradually.

Saving first. Investment later.

Yes, by controlling habits, not necessities.